library(ggplot2)

library(lmtest)Loading required package: zoo

Attaching package: ‘zoo’

The following objects are masked from ‘package:base’:

as.Date, as.Date.numeric

김보람

March 30, 2023

해당 자료는 전북대학교 이영미 교수님 2023응용통계학 자료임

Loading required package: zoo

Attaching package: ‘zoo’

The following objects are masked from ‘package:base’:

as.Date, as.Date.numeric

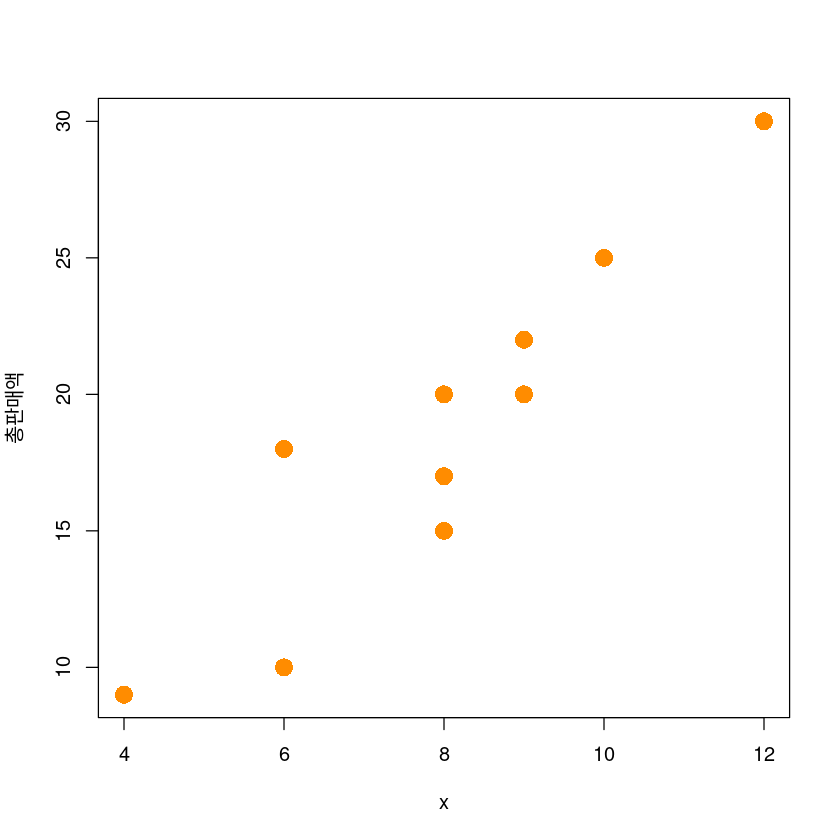

| x | y |

|---|---|

| <dbl> | <dbl> |

| 4 | 9 |

| 8 | 20 |

| 9 | 22 |

| 8 | 15 |

| 8 | 17 |

| 12 | 30 |

| 6 | 18 |

| 10 | 25 |

| 6 | 10 |

| 9 | 20 |

Warning message in plot.window(...):

“"lxab" is not a graphical parameter”

Warning message in plot.xy(xy, type, ...):

“"lxab" is not a graphical parameter”

Warning message in axis(side = side, at = at, labels = labels, ...):

“"lxab" is not a graphical parameter”

Warning message in axis(side = side, at = at, labels = labels, ...):

“"lxab" is not a graphical parameter”

Warning message in box(...):

“"lxab" is not a graphical parameter”

Warning message in title(...):

“"lxab" is not a graphical parameter”

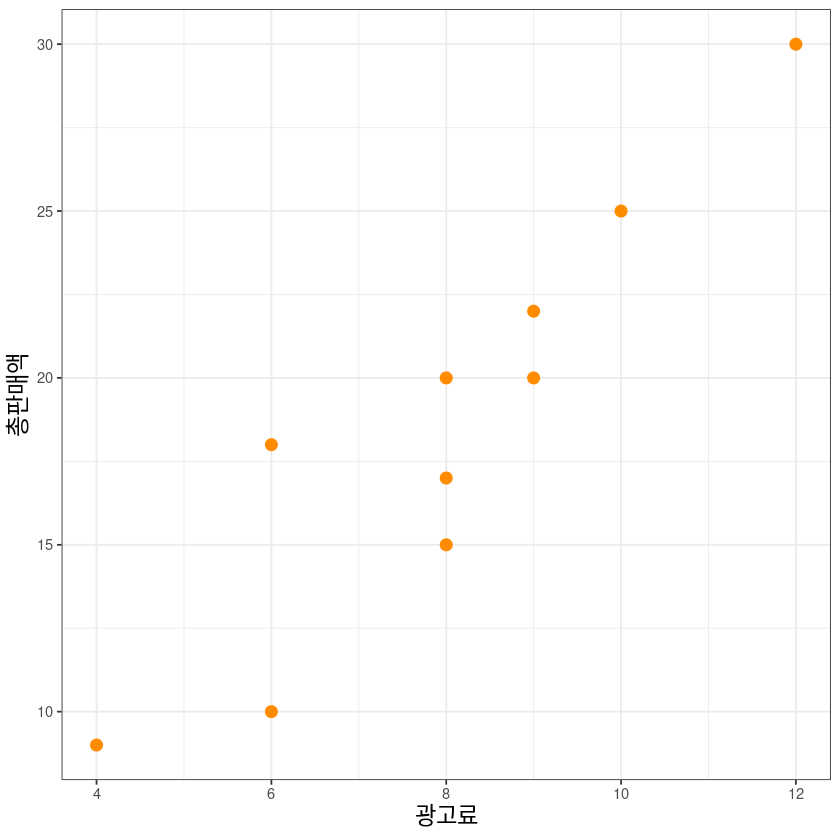

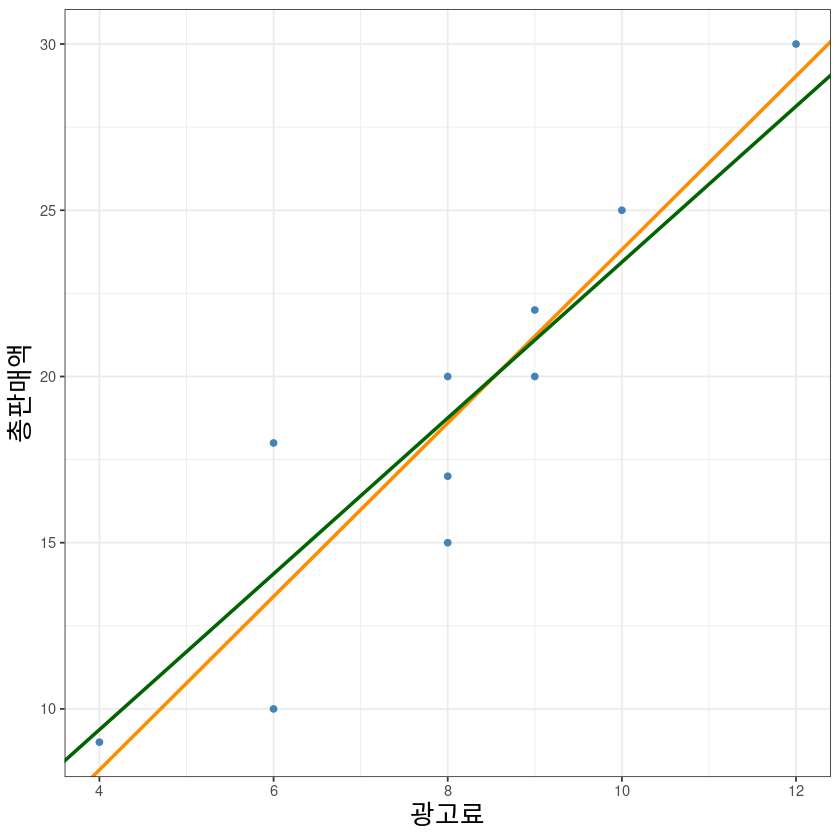

ggplot(dt, aes(x, y)) +

geom_point(col='darkorange', size=3) +

xlab("광고료")+ylab("총판매액")+

theme_bw() +

theme(axis.title = element_text(size = 14))

- 단순선형회귀모형 \[y= β_0 + β_1 x + ϵ\]

- 추정된 회귀직선

\[\widehat{y}=\widehat{E(y|X=x)}=\widehat{\beta_0}+\widehat{\beta_1}x\]

- 모형 적합

lm(formula, data)

formula: \(y=f(x)\), \(y\)(반응변수) ~ \(x\)(설명변수)

- 직접계산

\[\widehat{\beta_0} = \bar y - \widehat{\beta_1} + \bar x \]

\[\widehat{\beta_1} = \dfrac{S_{xy}}{S_{xx}}\]

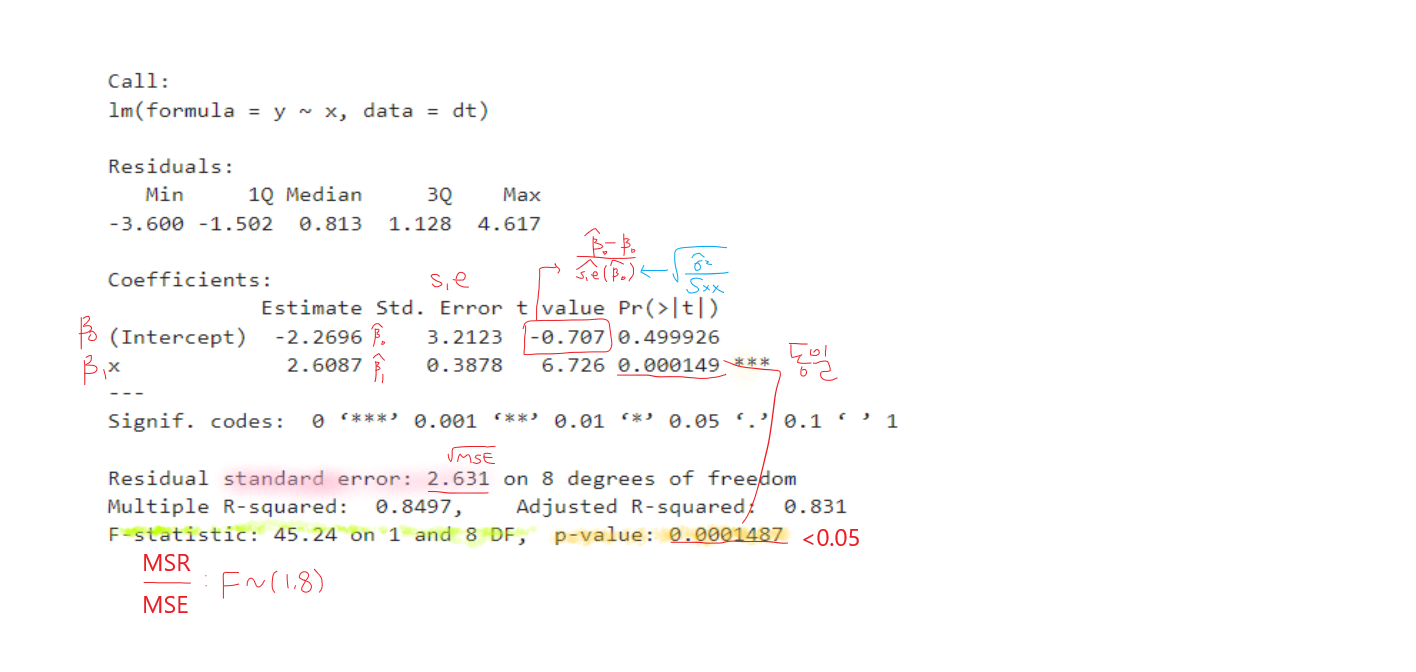

Call:

lm(formula = y ~ x, data = dt)

Residuals:

Min 1Q Median 3Q Max

-3.600 -1.502 0.813 1.128 4.617

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -2.2696 3.2123 -0.707 0.499926

x 2.6087 0.3878 6.726 0.000149 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.631 on 8 degrees of freedom

Multiple R-squared: 0.8497, Adjusted R-squared: 0.831

F-statistic: 45.24 on 1 and 8 DF, p-value: 0.0001487- summary

제일 먼저 F검정의 p-value값을 확인하자.

\(H_0\): \(\beta_1=0\) vs \(H_1\): not \(H_0\)

- 아래 값들은 모두 동일한 값을 리턴한다.

\[\widehat y = \widehat \beta_0 + \widehat \beta_1 x\]

- 아래 값들은 모두 동일한 값을 리턴한다.

\[e = y- \widehat y\]

| Df | Sum Sq | Mean Sq | F value | Pr(>F) | |

|---|---|---|---|---|---|

| <int> | <dbl> | <dbl> | <dbl> | <dbl> | |

| x | 1 | 313.04348 | 313.043478 | 45.24034 | 0.0001486582 |

| Residuals | 8 | 55.35652 | 6.919565 | NA | NA |

| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| (Intercept) | -2.269565 | 3.212348 | -0.7065129 | 0.4999255886 |

| x | 2.608696 | 0.387847 | 6.7260939 | 0.0001486582 |

| 2.5 % | 97.5 % | |

|---|---|---|

| (Intercept) | -9.677252 | 5.138122 |

| x | 1.714319 | 3.503073 |

\[\widehat \beta \pm t_{\alpha/2}(n-2) s.e(\widehat \beta)\]

\[y=\beta_1 x + \epsilon\]

Call:

lm(formula = y ~ 0 + x, data = dt)

Residuals:

Min 1Q Median 3Q Max

-4.0641 -1.5882 0.2638 1.4818 3.9359

Coefficients:

Estimate Std. Error t value Pr(>|t|)

x 2.3440 0.0976 24.02 1.8e-09 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.556 on 9 degrees of freedom

Multiple R-squared: 0.9846, Adjusted R-squared: 0.9829

F-statistic: 576.8 on 1 and 9 DF, p-value: 1.798e-09| i | x | y | x_barx | y_bary | x_barx2 | y_bary2 | xy |

|---|---|---|---|---|---|---|---|

| <int> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> |

| 1 | 4 | 9 | -4 | -9.6 | 16 | 92.16 | 38.4 |

| 2 | 8 | 20 | 0 | 1.4 | 0 | 1.96 | 0.0 |

| 3 | 9 | 22 | 1 | 3.4 | 1 | 11.56 | 3.4 |

| 4 | 8 | 15 | 0 | -3.6 | 0 | 12.96 | 0.0 |

| 5 | 8 | 17 | 0 | -1.6 | 0 | 2.56 | 0.0 |

| 6 | 12 | 30 | 4 | 11.4 | 16 | 129.96 | 45.6 |

| 7 | 6 | 18 | -2 | -0.6 | 4 | 0.36 | 1.2 |

| 8 | 10 | 25 | 2 | 6.4 | 4 | 40.96 | 12.8 |

| 9 | 6 | 10 | -2 | -8.6 | 4 | 73.96 | 17.2 |

| 10 | 9 | 20 | 1 | 1.4 | 1 | 1.96 | 1.4 |

- 직접계산

\[\widehat{\beta_0} = \bar y - \widehat{\beta_1} + \bar x \]

\[\widehat{\beta_1} = \dfrac{S_{xy}}{S_{xx}}\]

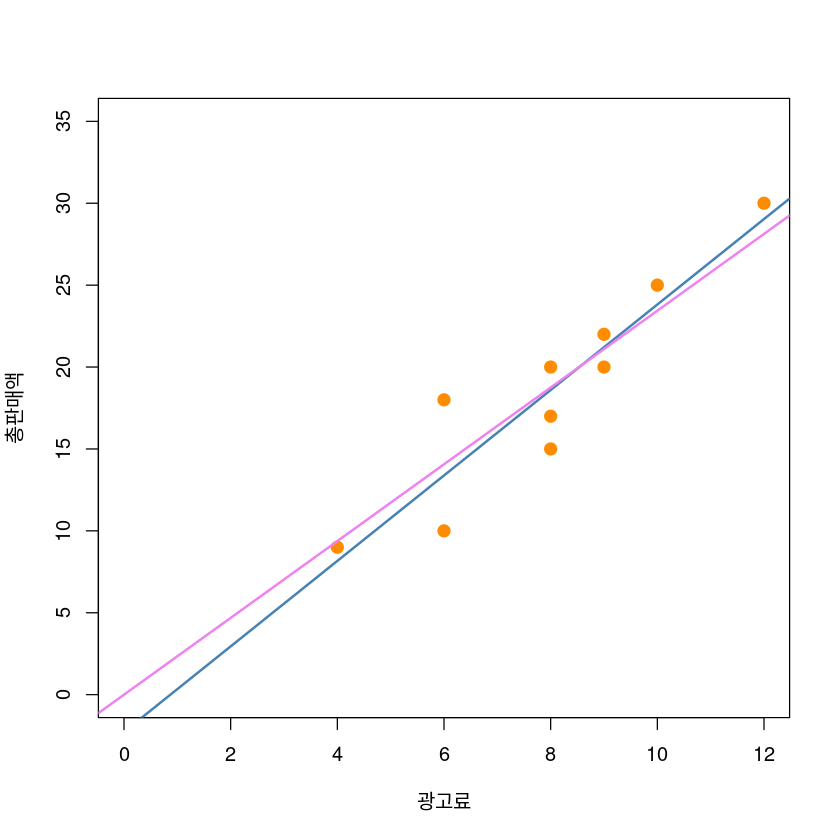

plot(y~x, data = dt,

xlab = "광고료",

ylab = "총판매액",

pch = 20,

cex = 2,

col = "darkorange",

ylim = c(0,35),

xlim = c(0, 12))

abline(model1, col='steelblue', lwd=2)

abline(model2, col='violet', lwd=2)

ggplot(dt, aes(x, y)) +

geom_point(col='steelblue', lwd=3) +

geom_abline(intercept = co[1], slope = co[2], col='darkorange', lwd=1) +

geom_abline(intercept = 0, slope = co_2, col='darkgreen', lwd=1) +

xlab("광고료")+ylab("총판매액")+

theme_bw()+

theme(axis.title = element_text(size = 16))Warning message in geom_point(col = "steelblue", lwd = 3):

“Ignoring unknown parameters: `linewidth`”

\[E(Y|x_0)\]

\[y=E(Y|x_0)+\epsilon\]

\[\widehat \mu_0 = \widehat y_0 = \widehat \beta_0 + \widehat \beta_1 4.5\]

| fit | lwr | upr | |

|---|---|---|---|

| 1 | 9.469565 | 5.79826 | 13.14087 |

| fit | lwr | upr | |

|---|---|---|---|

| 1 | 9.469565 | 2.379125 | 16.56001 |

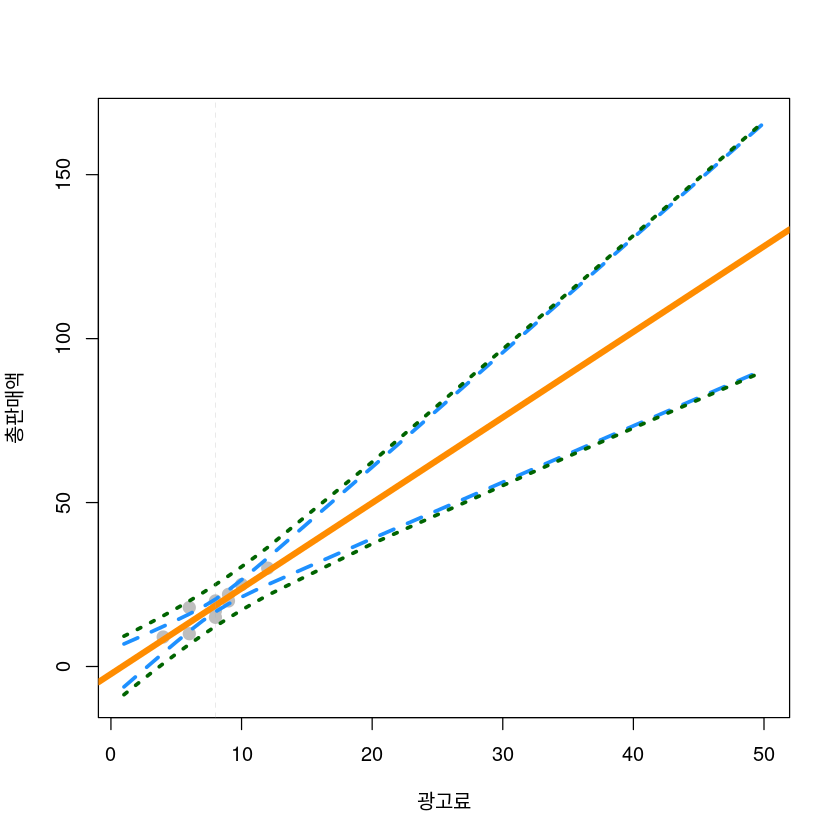

dt_pred <- data.frame(

x = c(1:12, 20, 35, 50),

predict(model1,

newdata=data.frame(x=c(1:12, 20, 35, 50)),

interval="confidence", level = 0.95),

predict(model1,

newdata=data.frame(x=c(1:12, 20, 35, 50)),

interval="prediction", level = 0.95)[,-1])

dt_pred| x | fit | lwr | upr | lwr.1 | upr.1 | |

|---|---|---|---|---|---|---|

| <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | |

| 1 | 1 | 0.3391304 | -6.2087835 | 6.887044 | -8.5867330 | 9.264994 |

| 2 | 2 | 2.9478261 | -2.7509762 | 8.646628 | -5.3751666 | 11.270819 |

| 3 | 3 | 5.5565217 | 0.6905854 | 10.422458 | -2.2199297 | 13.332973 |

| 4 | 4 | 8.1652174 | 4.1058891 | 12.224546 | 0.8663128 | 15.464122 |

| 5 | 5 | 10.7739130 | 7.4756140 | 14.072212 | 3.8692308 | 17.678595 |

| 6 | 6 | 13.3826087 | 10.7597808 | 16.005437 | 6.7738957 | 19.991322 |

| 7 | 7 | 15.9913043 | 13.8748223 | 18.107786 | 9.5667143 | 22.415894 |

| 8 | 8 | 18.6000000 | 16.6817753 | 20.518225 | 12.2379683 | 24.962032 |

| 9 | 9 | 21.2086957 | 19.0922136 | 23.325178 | 14.7841056 | 27.633286 |

| 10 | 10 | 23.8173913 | 21.1945634 | 26.440219 | 17.2086783 | 30.426104 |

| 11 | 11 | 26.4260870 | 23.1277880 | 29.724386 | 19.5214047 | 33.330769 |

| 12 | 12 | 29.0347826 | 24.9754543 | 33.094111 | 21.7358781 | 36.333687 |

| 13 | 20 | 49.9043478 | 39.0017505 | 60.806945 | 37.4278703 | 62.380825 |

| 14 | 35 | 89.0347826 | 64.8105387 | 113.259027 | 64.0626010 | 114.006964 |

| 15 | 50 | 128.1652174 | 90.5524421 | 165.777993 | 90.0664414 | 166.263993 |

| x | fit | lwr | upr | plwr | pupr | |

|---|---|---|---|---|---|---|

| <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | |

| 1 | 1 | 0.3391304 | -6.2087835 | 6.887044 | -8.5867330 | 9.264994 |

| 2 | 2 | 2.9478261 | -2.7509762 | 8.646628 | -5.3751666 | 11.270819 |

| 3 | 3 | 5.5565217 | 0.6905854 | 10.422458 | -2.2199297 | 13.332973 |

| 4 | 4 | 8.1652174 | 4.1058891 | 12.224546 | 0.8663128 | 15.464122 |

| 5 | 5 | 10.7739130 | 7.4756140 | 14.072212 | 3.8692308 | 17.678595 |

| 6 | 6 | 13.3826087 | 10.7597808 | 16.005437 | 6.7738957 | 19.991322 |

| 7 | 7 | 15.9913043 | 13.8748223 | 18.107786 | 9.5667143 | 22.415894 |

| 8 | 8 | 18.6000000 | 16.6817753 | 20.518225 | 12.2379683 | 24.962032 |

| 9 | 9 | 21.2086957 | 19.0922136 | 23.325178 | 14.7841056 | 27.633286 |

| 10 | 10 | 23.8173913 | 21.1945634 | 26.440219 | 17.2086783 | 30.426104 |

| 11 | 11 | 26.4260870 | 23.1277880 | 29.724386 | 19.5214047 | 33.330769 |

| 12 | 12 | 29.0347826 | 24.9754543 | 33.094111 | 21.7358781 | 36.333687 |

| 13 | 20 | 49.9043478 | 39.0017505 | 60.806945 | 37.4278703 | 62.380825 |

| 14 | 35 | 89.0347826 | 64.8105387 | 113.259027 | 64.0626010 | 114.006964 |

| 15 | 50 | 128.1652174 | 90.5524421 | 165.777993 | 90.0664414 | 166.263993 |

plot(y~x, data = dt,

xlab = "광고료",

ylab = "총판매액",

ylim = c(min(dt_pred$plwr), max(dt_pred$pupr)),

xlim = c(1,50),

pch = 20,

cex = 2,

col = "grey"

)

abline(model1, lwd = 5, col = "darkorange")

lines(dt_pred$x, dt_pred$lwr, col = "dodgerblue", lwd = 3, lty = 2)

lines(dt_pred$x, dt_pred$upr, col = "dodgerblue", lwd = 3, lty = 2)

lines(dt_pred$x, dt_pred$plwr, col = "darkgreen", lwd = 3, lty = 3)

lines(dt_pred$x, dt_pred$pupr, col = "darkgreen", lwd = 3, lty = 3)

abline(v=barx, lty=2, lwd=0.2, col='dark grey')

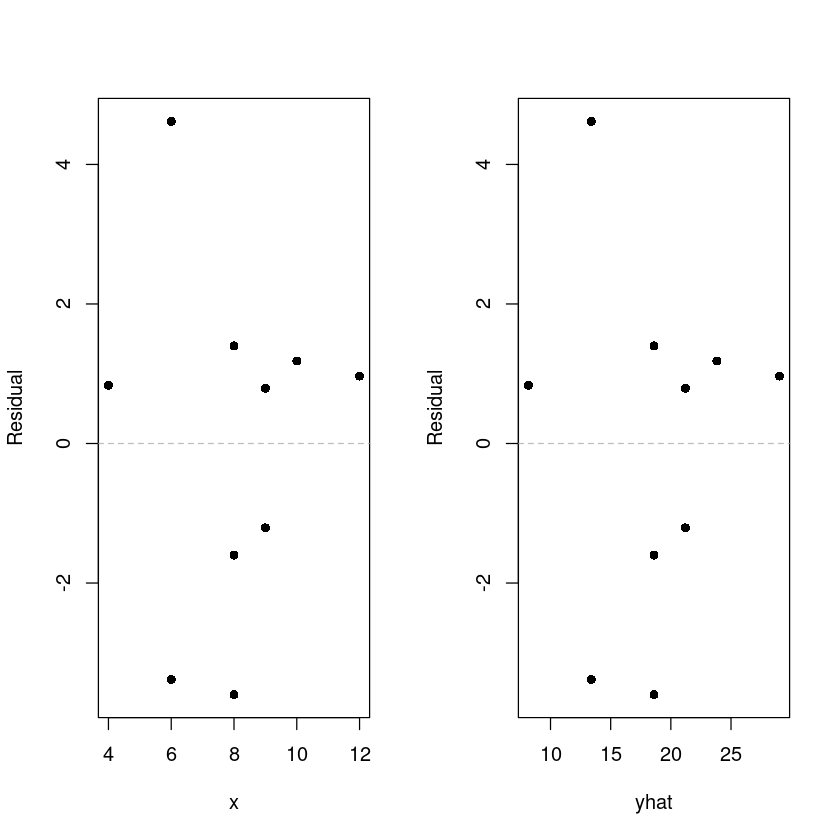

- \(\epsilon\) : 선형성, 등분산성, 정규성, 독립성

par(mfrow=c(1,2))

plot(resid ~ x, dt, pch=16, ylab = 'Residual')

abline(h=0, lty=2, col='grey')

plot(resid ~ yhat, dt, pch=16, ylab = 'Residual')

abline(h=0, lty=2, col='grey')

par(mfrow=c(1,1))

Durbin-Watson test

data: model1

DW = 1.4679, p-value = 0.3916

alternative hypothesis: true autocorrelation is not 0

Durbin-Watson test

data: model1

DW = 1.4679, p-value = 0.1958

alternative hypothesis: true autocorrelation is greater than 0